ABI February 2017: Business conditions bounce back

- Feb 21, 2017

- By webmaster

- In Uncategorized

Firms find research, particularly on building materials, to be important to their practice

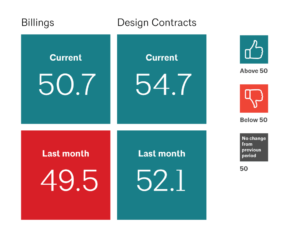

Architecture firm billings bounced back in February, following a slight decrease in January. Architecture firms reported modest growth for the month, as the ABI score rebounded to 50.7 (any score over 50 indicates billings growth). Inquiries into new projects remained strong, and the largest share of firms in more than two years reported an increase in the value of new design contracts as new work in the pipeline continues to ramp up.

Business conditions at architecture firms improved in three of the four regions of the country in February, but growth was sluggish in the Northeast and South. Firms located in the Midwest reported stronger growth, while firms located in the West reported declining firm billings for the seventh month out of the last eight. In addition, firm billings softened at firms with a residential specialization, as well as those with a commercial/industrial specialization. Firms with an institutional specialization continued to see growth, but at a modestly slower pace than in the last two months.

The general economy remained relatively strong in February, as nonfarm payroll employment increased by 235,000 new positions, with construction employment contributing 58,000 of those positions. Construction employment has now increased by a total of more than 175,000 in the last six months, accounting for 15 percent of the 1,165,000 nonfarm payroll jobs added in that same period. Architectural services employment was essentially flat from December to January (the most recent data available), declining modestly to total employment of 184,900. And despite the fact that building permits for new, privately-owned housing units decreased by 6.2 percent from January to February, they are still up by 4.4 percent from one year ago. In addition, privately-owned housing starts increased by 3.0 percent from January to February, and single-family starts increased by 6.5 percent in that same period.

How important is research?

Research is one of the important tools that many architecture firms rely on as part of their practice, and this month’s special practice question asked responding firms about the importance of research to their practice, as well as the usefulness of research practices and tools. Nearly all responding firms indicated that research was either somewhat or very important to their practice, with two-thirds indicating that they find research on building materials to be very important. In addition, 49 percent of firms indicated that research on life-cycle costs was very important, followed by research on sustainability and resilience (48 percent very important), research on post-occupancy evaluations (33 percent very important), and research on human health (30 percent very important).

A much larger share of firms with an institutional specialization indicated that research on human health is very important (40 percent, versus 28 percent of commercial/industrial firms and 16 percent of residential firms), and institutional firms were also more likely to place a higher importance on research on post-occupancy evaluations and life-cycle costs than firms with other practice specializations.

When asked about the usefulness of research practices and tools to making specific decisions at their firm, 47 percent indicated that they find case studies to be very useful, followed by building research databases (31 percent very useful), architecture magazines like ARCHITECT and Architectural Record (27 percent very useful), Knowledge Community web sites and publications (25 percent very useful), and architectural journals like the Journal of Architectural Education (22 percent very useful). Firms with a residential specialization were less likely than firms of other practice specializations to find building research databases and Knowledge Community web sites and publications to be very useful.

This month, Work-on-the-Boards participants are saying:

“The other side of being busier is now coming into play – salaries are going up and hiring has gotten tougher.” —109-person firm in the South, commercial/industrial specialization

“We expect to see several projects break loose once the state budget is passed.” —25-person firm in the Northeast, institutional specialization

“Multifamily housing continues to dominate the market with several new projects starting in the area each month. Several mixed use commercial projects are moving cautiously forward.” —11-person firm in the Midwest, commercial/industrial specialization

“Seemed to have flattened the last couple of months, but we’re now seeing an uptick in inquiries.” —3-person firm in the West, residential specialization